Reinvestment rate formula

NOPAT is equal to EBIT x 1 tax rate Determining the Value of a Company. In order for an investor to actually receive the expected yield to maturity he or she must reinvest the coupon payments at a rate equal to the yield to maturity 10.

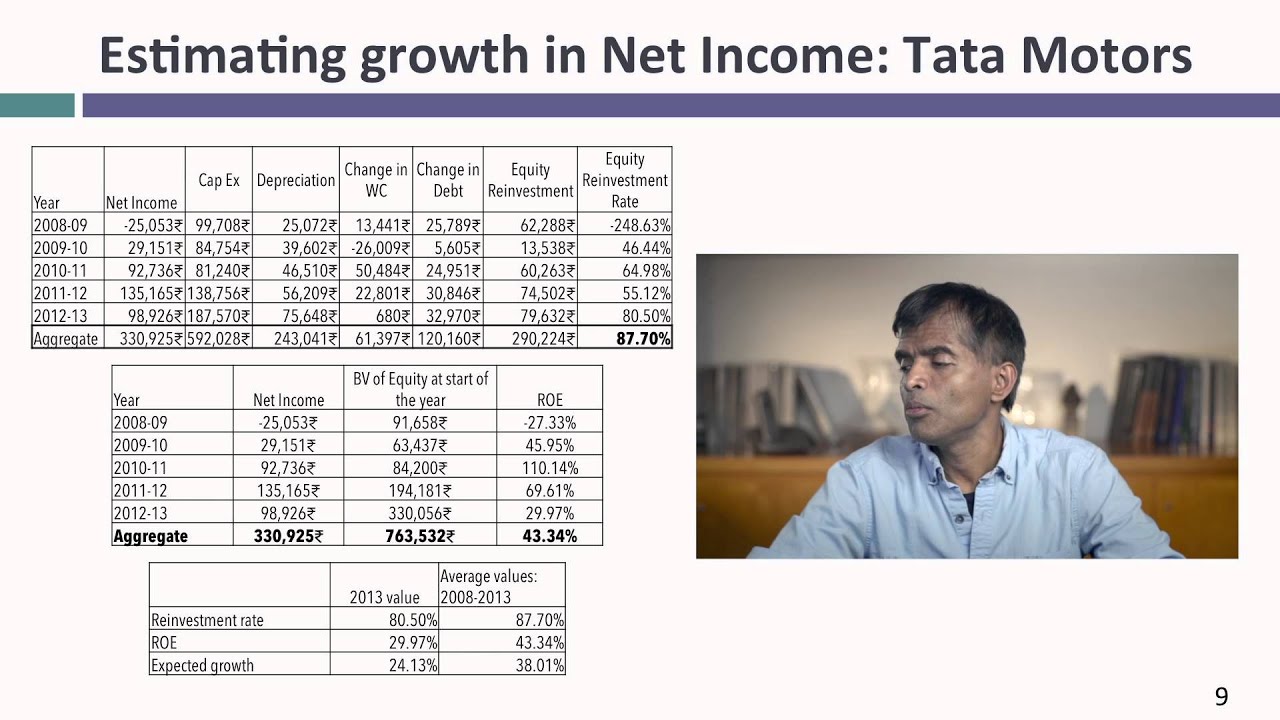

How To Use Reinvestment Rate To Project Growth For Valuation

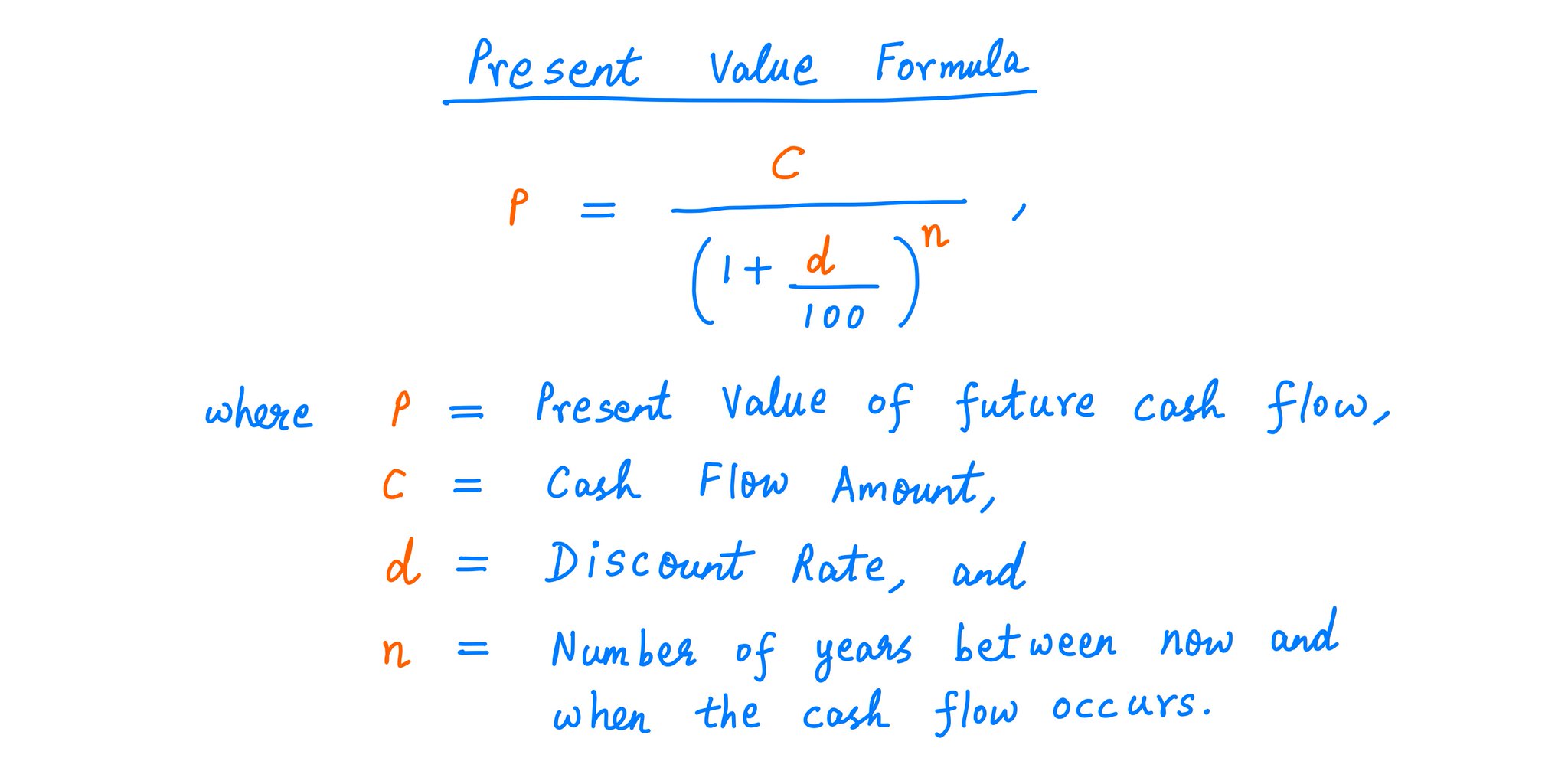

It can be calculated using the following formula.

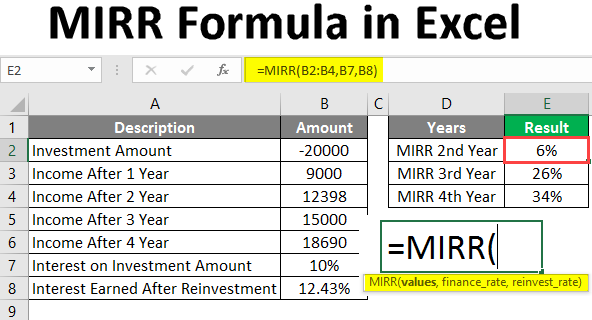

. Following is the explanation to this formula. It is also the amount of interest that an investor can earn when the. MIRR cash flows financing rate reinvestment rate Where.

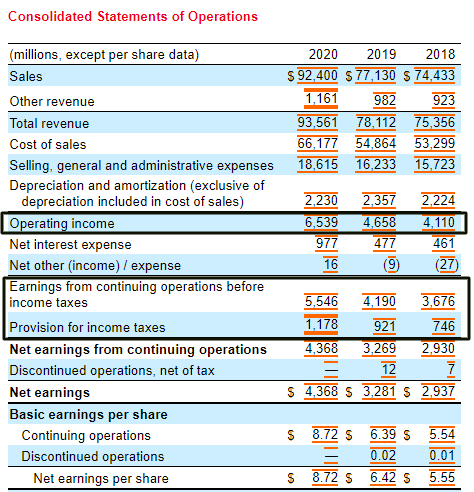

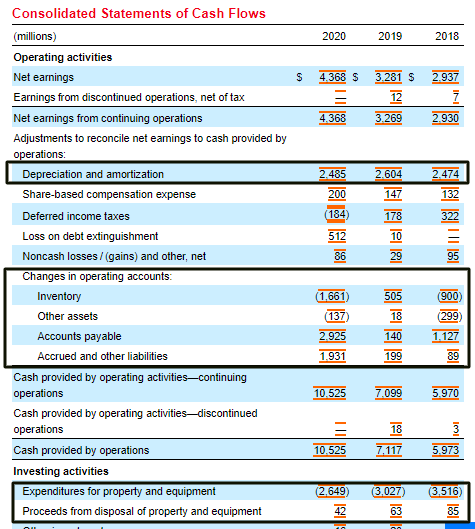

This is illustrated in Table 1. Start Growing Your Savings With Research Tools Provided By These Top-Reviewed Brokerages. Increase in fixed assets Increase in working capital Net income Noncash expenses Noncash sales - Dividends Example.

Hence FV 300 1012 2 600 1012 1 900 300 125 600 112 900 375 672 900 1947. The formula for the cash reinvestment ratio is. A company can evaluate its growth by looking at its return on invested capital ratio.

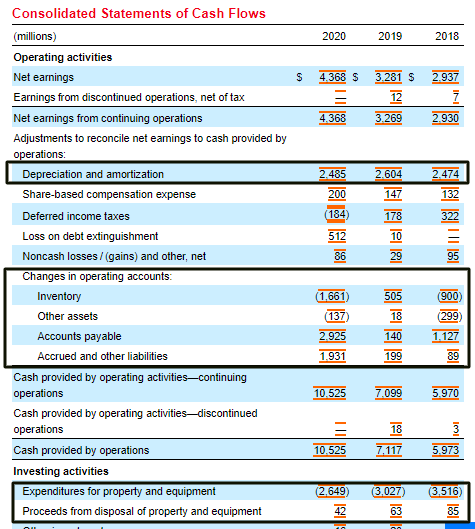

Equity reinvested in business Capital Expenditures Depreciation Change in Working Capital New Debt Issued Debt Repaid Dividing this number by the net income gives us a much. FV P 1 r m mt. Reinvestment Rate Net CapEx Change in NWC NOPAT Lets define these terms.

What is Net CapEx. Experimentation to Find the Right Reinvestment Rate Once the data has been collected and a. Cash Flows Individual cash flows from each period in the series Financing Rate Cost of borrowing or.

The equation used to calculate the reinvestment rate is as follows. Ad These Top Brokerages Offer Tools For New Investors And Those With Years Of Experience. Cash Reinvestment Ratio Increase in Fixed Assets Increase in Working Capital Net Income.

Reinvestment rate refers to the rate at which cash flows from an investment can be reinvested into another. Cash flow from operations - dividends net income depreciation - increase in working capital - decrease in fixed assets. Formula The equation for the cash reinvestment ratio is as follows.

A casinos player reinvestment rate on a monthly basis. The cost of capital and the reinvestment rate was 12. Reinvestment Rate CAPEX DA Working Capital EBIT 1-t This way rather than projecting each individual component of reinvestment separately we can combine.

The financial management rate-of-return formula still assumes Ryan will reinvest the entire 300 per month but allows the person doing the analysis to pick a reinvestment rate. Dividend Yield Annual Dividend Stock Price 100 Dividend Reinvestment Formula.

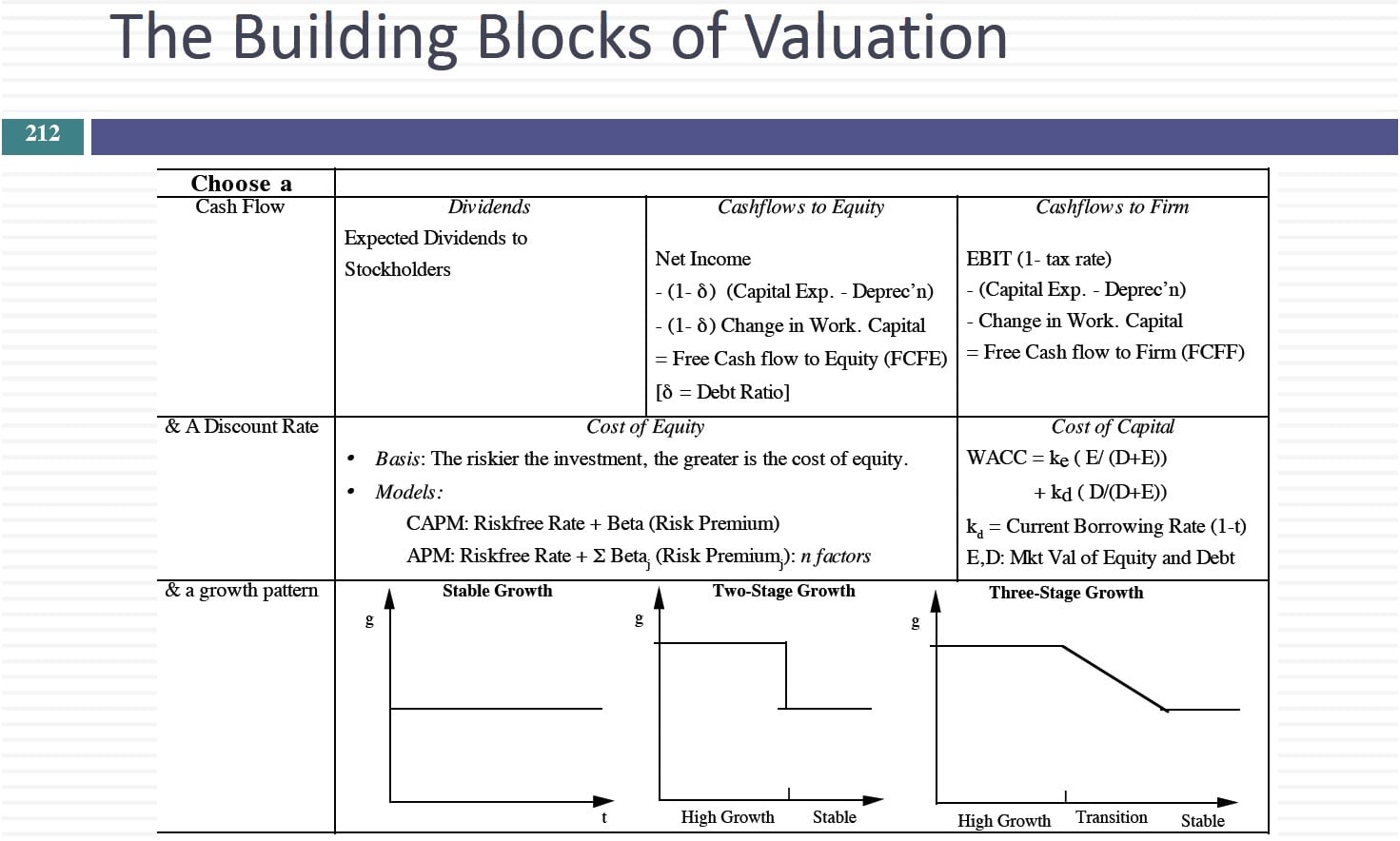

Session 31 Cash Flows Growth Rates Youtube

Myth 5 3 Growth Is Good More Growth Is Better By Aswath Damodaran Harvest

10 K Diver On Twitter 13 Here S A Formula To Calculate The Present Value Of A Future Cash Flow Along With A Couple Examples As You Can See The Formula Takes A Cash

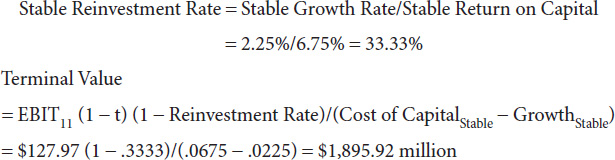

Reinvestment Rate Terminal Value Model Choice

Corporate Valuation Free Cash Flow Approach Ppt Download

The Light Side Of Valuation How To Value Growth Companies Informit

The Ultimate Guide To Advanced Discounted Cash Flow Analysis Dcf How To Value A Company Stockbros Research

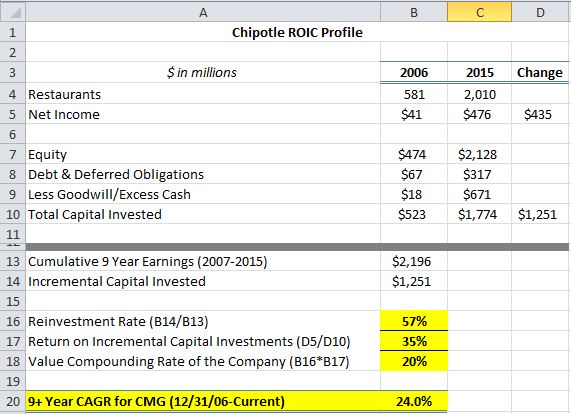

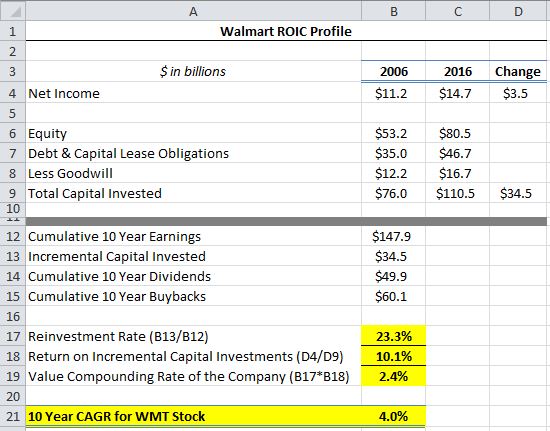

Calculating The Return On Incremental Capital Investments Saber Capital Management

Calculating The Return On Incremental Capital Investments Saber Capital Management

Reinvestment Rate Formula And Calculator Excel Template

Reinvestment Rate Formula And Calculator Excel Template

Session 10 Growth Rates Terminal Value Model Choice Youtube

Cfa Tutorial Fixed Income Reinvestment Income Ytm Yield To Maturity Youtube

Mirr Formula In Excel How To Use Mirr Function With Examples

The Fundamental Determinants Of Growth

How To Use Reinvestment Rate To Project Growth For Valuation

Level I Cfa Tutorial Fixed Income Reinvestment Assumption In Calculating Yield To Maturity Ytm Youtube